Are you looking to prepare paystubs for your small business employees, but aren’t quite sure how to do it? Preparing paystubs can be tedious work, however, it’s necessary for keeping a paper trail of your employees’ earnings.

But, how do you prepare a paystub?

Check out this guide to discover the best practices for preparing paystubs for small business employees.

What is a Paystub?

Before we discuss how to prepare paystubs, let’s talk about what they are. A paystub tells the details of a paycheck and it shows employees how their paychecks are calculated.

While in the past paystubs always accompanied paper checks, with the growth of digital deposits, paystubs are now commonly digital documents that are a part of a business’s payroll software.

The federal government requires businesses to keep track of the number of hours their employees work as well as their wages. And, many states require you to take it a step further by making it a mandatory law that you need to make paystubs available to all of your employees.

If an employee needs to apply for a loan, they can use their paystub as proof of income. Paystubs also help provide transparency in regards to an employee’s pay, which makes it easier to spot errors.

Tips for Preparing Paystubs

So, how do you prepare a pay check stubs? Here’s what you need to include:

-

Name, Address, and Pay Period

To make it easy to identify which paystub belongs to which employee, each paystub should include the employee’s name and full address. It’s also a good idea to add the employee’s identification number as well as the last four digits of their Social Security number.

The pay period refers to the week, two weeks, or month in which you’re paying the employee. Note, the pay period date is different than the paystub issuance date. The pay period should specify the exact dates of pay that are included on their most recent paycheck.

-

Hours Worked

If your employees are paid an hourly wage, the paystub should also include the number of hours each employee worked in a pay period. Depending on the industry you work in, the number of hours worked may need to be broken down according to role.

For example, if you own a restaurant, you may need to specify hours worked as a bartender and hours worked as a server.

-

Gross Pay and Deductions

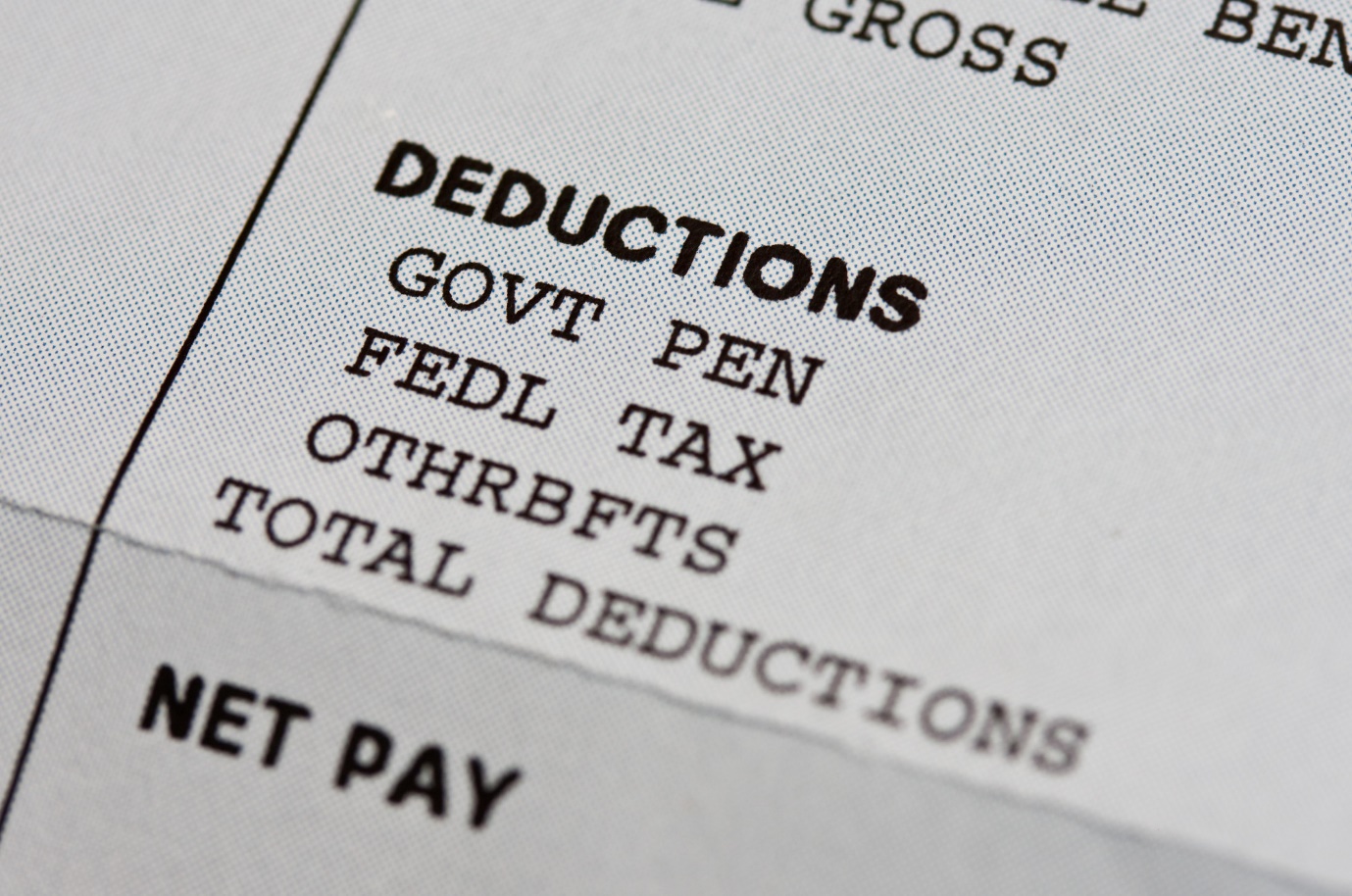

The gross pay refers to how much an employee earned in a pay period before taxes and other deductions were taken out. The gross pay should include commissions, tips, bonuses, and all other extra earnings.

The paystub should also list all deductions, including taxes, retirement benefits, healthcare insurance premiums, union dues, and more. The paystub should also specify the net pay, which is the amount of money that reaches the employee’s hands after all of the deductions are taken out.

Are You Ready to Prepare Your Paystubs?

Now that you’ve read this guide, it’s time for you to start preparing your paystubs for your employees. Because it’s required by law, you want to make sure you complete the paystubs in an accurate and efficient manner.

Most businesses invest in payroll software to help them out with this task. For more tips on running your small business, be sure to check back in with our blog.