Enzolytics Inc provides some support at $0.0783 thanks to accumulating volume. This area may offer a buy signal as an upward rebound is likely when the base is challenged. This enzc stock has moderate day-to-day swings and a high trading volume. Thus the risk is deemed moderate.

Enzolytics, Inc. is a medication research firm focused on commercializing its unique protein and biologics to treat viral disorders that are debilitating. The enzc stock forecast is building a number of therapies to treat a variety of viral disorders. ITV-1 (Immune Therapeutic Vaccine-1) is a copyrighted and lab-proven solution of rendered inert Proteolysis enzymes Fraction (IPF). Which is protected by US Patents Nos. 8,066,982 and 7,479,538? It has been found in studies to be effective in the treatment of HIV/AIDS. The immune response has also been found to be modulated by ITV-1.

Some important information about enzc stock forecast

The company’s patented method is also being used to develop humanized monoclonal antibodies (mAbs). This is also against infections such as HIV, rabies, pandemic A, seasonal flu B, anthrax, and diphtheria. Furthermore, its specialized methods for generating humanized monoclonal immunoglobulin. Which is coated in its awaiting U.Senzc stock message board? New Patent is presently being used to develop immunotherapy therapies for a variety of infections, such as the Coronavirus (SARS-CoV-2) and HTLV-1.

The above media release includes forward-looking declarations. That entails potential risks related to financial forecasts, expenditures, breakthrough timeframes, clinical advancement, and approvals. As well as other dangers detailed by enzc stock price Inc. In its periodic reports filed with the SEC from time to time, The US Administration of Fda regulatory as well as any other analogous regulatory authorities across the world have not authorized ITV-1.

Enzolytics Inc also believes in the forward-looking statement. This statement contains underlying assumptions that are reasonable. On the other hand, the ability of Enzolytics has established the efficiency of treatment. The enzc stock price carries successful outcomes that deliver development plans in such studies and tests. Moreover, there is also has the assurance that provides accurate statements.

The components of enzc stock message board

Enzolytics inc has stock from $0.0787 TO $ 0.0781.The stock fluctuates, by 5.53% from the low at$0.0760 to the high of $0.0802.For this time period, the price has been fluctuating, with a -5.94 percent decline in the last 2 weeks. On the last day, volume grew by 1 million, although at a lower price. This could be an early warning sign, as well as the risk will start rising in the coming days. A total of 4 million units were purchased for $281.23 thousand dollars.

In the near term, the stock is trading at the bottom of a very wide and downward trend. This could indicate a strong buying opportunity. If the drop floor of $0.0729 is breached, it will signal a faster rate of decline. Given the present relatively brief trend, the stock is anticipated to lose -25.22 percent during the next 3 years. With a 90% likelihood, end the quarter with a price between $0.0545 and $0.0745. Please keep in mind that if the market price stays at present levels or rises. Our projection target will begin to shift favorably over the next few days, as the present forecasts criteria will be fulfilled.

The upcoming news for enzc stock message board

The early return on the upcoming news is likely to be quite low, while the daily expected value is present -0.69%. The relative hype sensitivity to Enzolytics has volatility of 323.96 percent enzc stock message board. The projected price after the next statement by the competitors is -1.05. The volatility of connected excitement on Enzolytics is roughly 323.96 percent. A deficit of 4.76 cents per share was registered by the corporation. In previous years, Enzolytics hadn’t yet paid any dividend. On February 7th, 2013, the entity disbanded. Given a 90-day equity portfolio, the next anticipated press release will be fairly short.

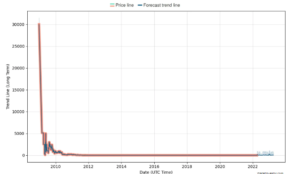

FIG: 1

The price line of enzc stock

A buying opportunity in enzc stock forecast

A break-through lengthy mean will generate a new buying opportunity. While a drop below the short-term average will generate a new sell signal, thereby strengthening the overall message. On the last day, Enzolytics Inc increased volumes, but at a loss of value. This is known as a dispersion in technical terminology, and it could be an early sign. Case of increase on declining prices can be regarded as favorable in some situations. However, this is more common in “sell-offs.

The brief moving average is indicating a purchase signal for Enzolytics Inc. The lengthy average is indicating a broad sales forecast. Because the long-term average is higher than the long average. The stock has a broad sell signal, indicating a much more bearish outlook. The stock will run into opposition from the long-term rolling average at $0.0830.If the stock falls, the brief average at $0.0780 will provide some protection.

Fig: 2

The stock market forecast

This company has moderate day-to-day swings and an increased trading turnover. The risk is deemed moderate. The stock changed $0.0042, or 5.53 percent, from high and low in the previous day’s enzc stock forecast. The company has had an average daily fluctuation of 4.47 percent in recent weeks.

| Regeneron pharmaceuticals | 7.43 | 10 per month |

|---|---|---|

| Moderna | 2.25 | 9 per month |

| Vertex pharmaceutical | 1.00 | 5 per month |

| Biontech Se ADR | 0.80 | 5 per month |

| Alexion Pharmaceuticals | 0.00 | 0 per month |

Using various technical indications, we give a set of tools to spot possible entry and exit positions for Enzolytics. When looking at Enzolytics charts, keep in mind that event formation could signal an entry moment for a retail investor. Look at additional indications overtime to ensure that a break or reversal is imminent.

enzc stock prediction

Fig: 3

The stock market prediction

The historical price enzc stock forecast 2021

| Date | Opening price | Closing price | Minimum price | Maximum price |

|---|---|---|---|---|

| 23-11-2021 | 0.1166 | 0.1166 | Low: 0.1166 | High 0.1166 |

| 22-11-2021 | 0.12 | 0.12 | Low 0.12 | High 0.12 |

| 19-11-2021 | 0.1227 | 0.1227 | Low 0.1227 | High 0.1227 |

| 18-11-2021 | 0.1265 | 0.1265 | Low 0.1265 | High 0.1265 |

| 17-11-2021 | 0.13 | 0.13 | Low 0.13 | High 0.13 |

| 16-11-2021 | 0.1263 | 0.1263 | Low 0.1263 | High 0.1263 |

| 15-11-2021 | 0.1296 | 0.1296 | Low 0.1296 | High 0.1296 |

The table above shows 7 days of historic ENZC stock prices. If you look at the data closely, you can notice that the price cap, lowest possible price, closing price, and starting price of ENZC Stock are all falling. However, there are considerable changes, indicating that it has the capacity to yield money over the long term.

Upcoming enzc stock prediction enzc stock forecast 2021

| Date | Price | Main price | Max price |

|---|---|---|---|

| 26-11-2021 | 0.116 | Min : 0.111 | Max: 0.121 |

| 29-11-2021 | 0.117 | Min :0.113 | Max: 0.122 |

| 30-11-2021 | 0.114 | Min :0.1095 | Max: 0.199 |

| 01-12-2021 | 0.115/th> | Min :0.111 | Max: 0.120 |

| 02-12-2021 | 0.113 | Min :0.1083 | Max: 0.118 |

| 03-12-2021 | 0.114 | Min :0.1092 | Max: 0.119 |

| 06-12-2021 | 0.115 | Min :0.110 | Max: 0.120 |

| 07-12-2021 | 0.112 | Min :0.1067 | Max: 0.116 |

The table above shows the expected price of ENZC stock in the near future. As you can see in the data, the cost on 7th December 2021 would be slightly lower than on November 26th, 2021. The ENZC stock projection, however, has multiple oscillations in between. For instance, on December 6, 2021, the market may hit a high of $0.120. Similar trends can be noticed in both the lowest and normal pricing ranges. As a result, it has the potential to rise in the not-too-distant future.

Market rank enzc stock forecast 2025

On Tuesday, March 28, 2022, a buy recommendation was provided from a hinge bottom point and has since increased by 1.65 percent. More upward movement is expected until the best starting hinge is discovered. Moreover, the three months Moving Average Missense Mutation gives a buy signal (MACD). Positive signals were also sent out, but these could have an impact on the near-term trajectory in enzc stock forecast 2025. The relatively brief rolling average is indicating a purchase signal for Enzolytics Inc. The lengthy average is indicating a broad sales forecast. Because the long-term mean is higher than the long average. The stock has a broad sales forecast, indicating a much more bearish outlook.

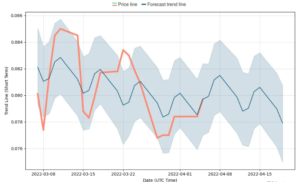

Fig: 4

The forecast trend line

Enzolytics currently trades at 0.80. The entry stock has no elasticity on its hype. The average elasticity has competition with the enzolytics forecast. Enzolytics predicted that the market will not respond to the next news, with prices remaining stable and median media frenzy impact fluctuation exceeding 100%.

Read more about the TSNP Stock forecast.